Financial network value WiFi solution

Financial branches are an important channel for banks, securities and investment institutions to expand business and enhance brand effect rapidly; service quality has become an important factor that affects a bank’s reputation directly and a critical means in competition among banks; conventional financial branches are confused about how to improve user service quickly.

The emergence and application of WIFI (Wireless Fidelity) in bank branches not only relieved pressure on bank branches’ business process, enhanced work efficiency and improved service level, but also changed banks’ operational concepts, broadened their management ideas and helped bank branches to change from the conventional service mode to the Internet financial mode.

User demands for branch WiFi construction:

| Reduce customer complaints about waiting and relieve pressure of tellers; | | Combine customized demands with the original bank business system; |

| Big data accurate marketing; | | Promote enterprise WeChat and Mobile APP rapidly; |

| Convert potential customers into closing customers; | | WiFi construction security compliance disclaimer. |

System design of ABT value WiFi solution

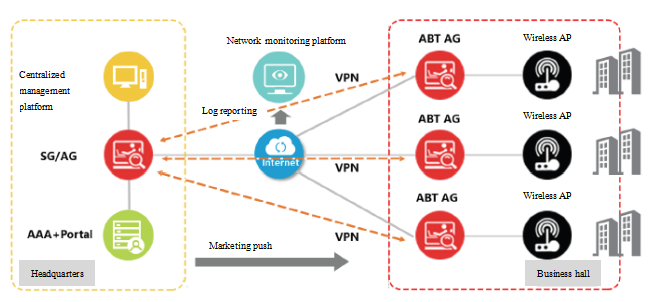

The headquarters-branches network framework that uses IPsecVPN in the interconnection of headquarters and branches ensures security and secrecy in data transmission;

Users’ log-in are converged at the central end for real-name authentication before they are allowed to access Internet. AG equipment provides users’ virtual image data for the big data analysis platform after behavior audit. Finally, various contents are sent to different branches and user groups for accurate marketing effect;

Meanwhile, the whole solution meets the requirements of police connection and compliance.

Major value of the solution:

Flexible and easy authentication method

| Users can be authenticated through WeChat, portal, text, APP and other methods; they can also switch to/choose another authentication method flexibly according to their own situation. Multiple authentication methods support the real name registration system and meet the requirements of real-name audit; |

Personalized interfaces

| Detailed domain definition pages and many templates are provided for users; UI that is identified with HTML code by advanced users is run; configuration of advertisement displaying in turns is supported; the advertisement can be directionally pushed in the ways including user-oriented, equipment-oriented and SSID; |

Customer service differentiation

| Differential services are provided for different users according to user demands. Remind lobby managers when on VIPs’ arrival. Provide VIPs with better online service and service of higher quality; |

Efficient auxiliary marketing promotion

| APP and content materials promoted by financial institutions are stored in gateway local cache, lowering enterprises’ marketing costs in rapid promotion of APP without impacting on users’ network usage experience; |

Big data analysis accurate marketing

| Through accurate user behavior identification, users’ interests and hobbies are analyzed in order to provide quality data and user images that are highly reliable for the big data platform; enterprises can also enhance overall branch service efficiency by using data like customer flow and user retention time. |

Shape a safe Internet environment

| Based on application layer security, virus, Trojans, malicious websites, fraudulent websites and attacks are filtered to ensure Internet security in the branch; special IPsec VPN secure channel is constructed with special hardware encryption chips to ensure the safe data transmission between branches and headquarters. |

Meet national policy compliance

| Gateway accurate audit, mass storage and perfect connection capacity ensure the compliance operation of branch WiFi powerfully. |